Online movies as alternative asset class

Investing in alternatives is different than investing in traditional investments such as stocks and bonds. Alternatives tend to be illiquid and highly specialized. When building a portfolio that includes alternative investments, investors and their financial advisors should first consider an individual’s financial objectives. Investment constraints such as risk tolerance, liquidity needs and investment time horizon should be determined.

Liquidity

Most alternative investments on the market are private equity investments and the typical downside of such investments is a long lockup period of funds. Movies have always been an alternative asset class that provides the most liquidity to an alternative portfolio, compared to any other alternative asset class when invested as gap financing loan or as private equity through government subsidised tax deductions schemes; they also have some downside protection. Both of these investments have their short comings – either low yield for gap finance or only partial guaranteed return on investment for government-subsidised schemes.

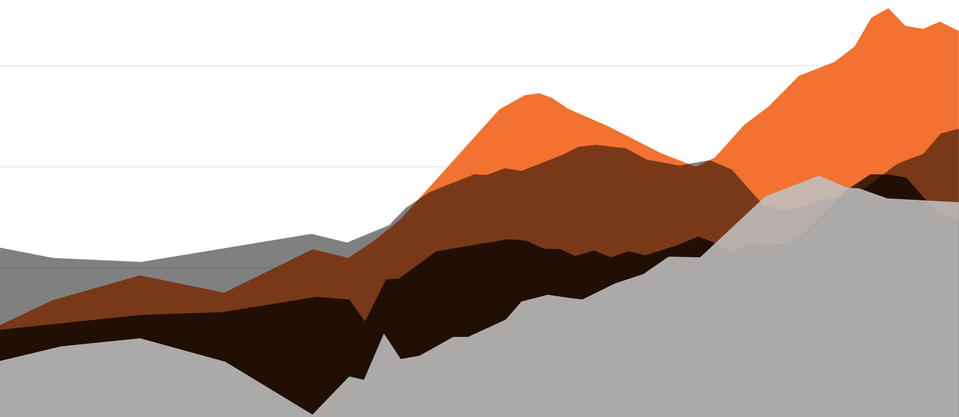

Volatility

Volatility in online movie investments

Traditional equity based movie investments are known to be very volatile, while at the same time producing occasional break out hits. Online movies are still volatile but much more predictable because single investments are at micro budget level with faster recoupment timelines. You Go Far works only with sales agents who are interested in reselling those movies to clients that are willing to buy them; in return You Go Far offers sales agents financing in a form of investment which is much more attractive to them than collaterally-backed factoring loans that they often use to finance.

For equity investors, this is an opportunity to acquire an asset that is not correlated to traditional markets, thereby reducing the average volatility in their investment portfolio.