The new normal

Low yields, increased market volatility and rising asset correlations are prompting investors to rethink traditional portfolio construction. Investing across a wider range of asset classes may help investors generate income and growth and diversify their portfolios.

Rising correlations

One inherent challenge to building a diversified portfolio in today’s market is finding investments that provide an attractive rate of return and behave differently than one another in a portfolio. Before the 2008 financial crisis, many investors believed a portfolio composed of 60% stocks and 40% bonds provided sufficient diversification. Today, however, stocks and bonds are more correlated than they were in the past, causing many investors to reconsider this allocation strategy.

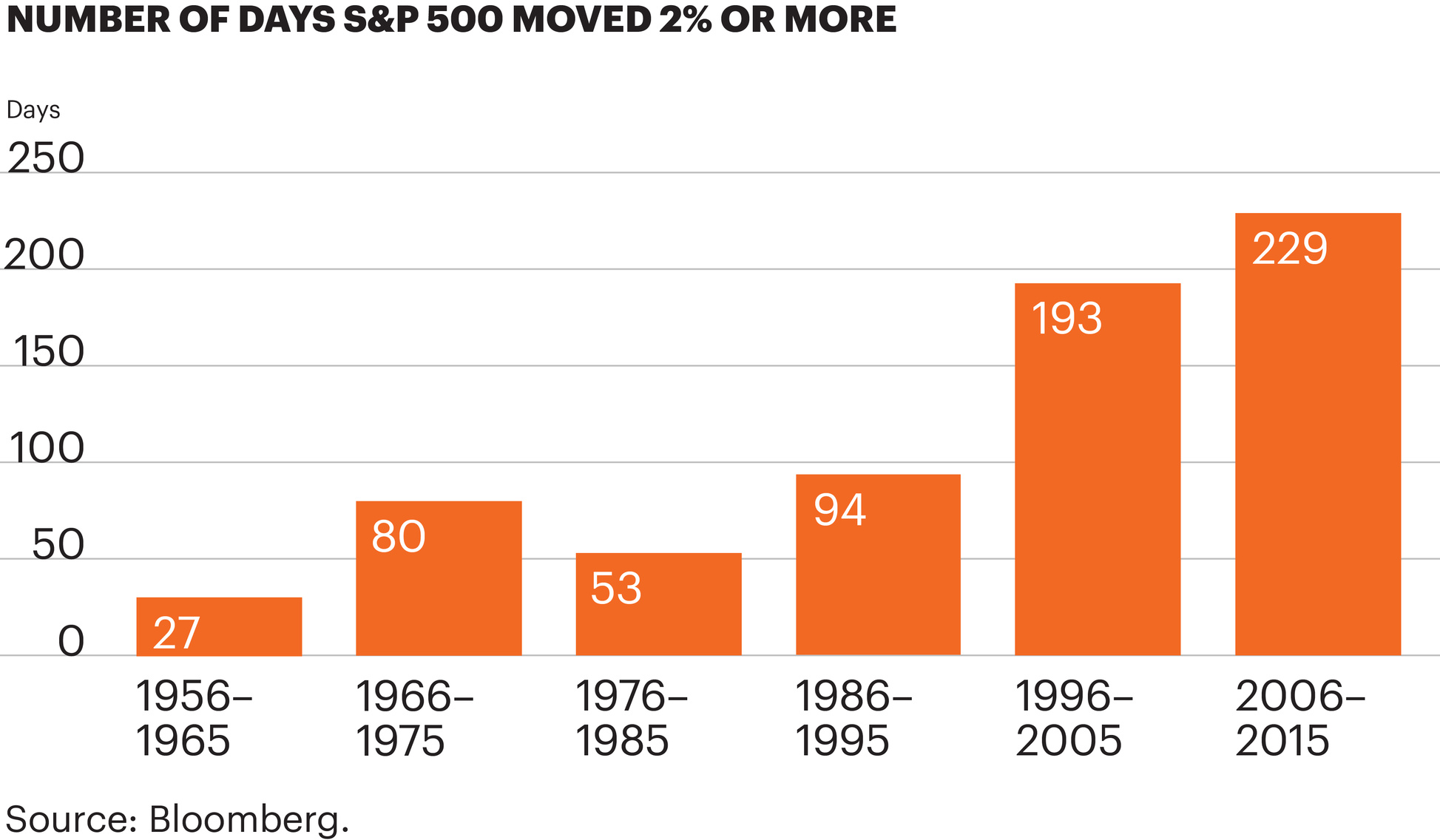

Increased volatility

Rising market volatility, marked by swift changes in investor sentiment, has led to sizable swings in the performance of stock and bond markets with increased frequency.

Defaulting to Mindfulness

Everything along the way, to and from, fascinated her: every pebble, ant, stick, leaf, blade of grass, and crack in the sidewalk was something to be picked up, looked at, tasted, smelled, and shaken. Everything was interesting to her. She knew nothing. I knew everything…been there, done that. She was in the moment, I was in the past. She was mindful. I was mindless.